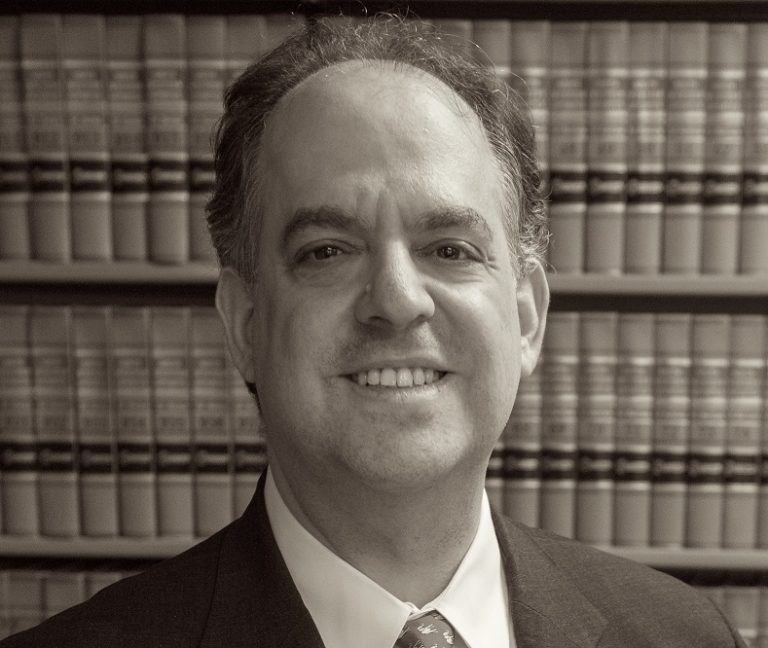

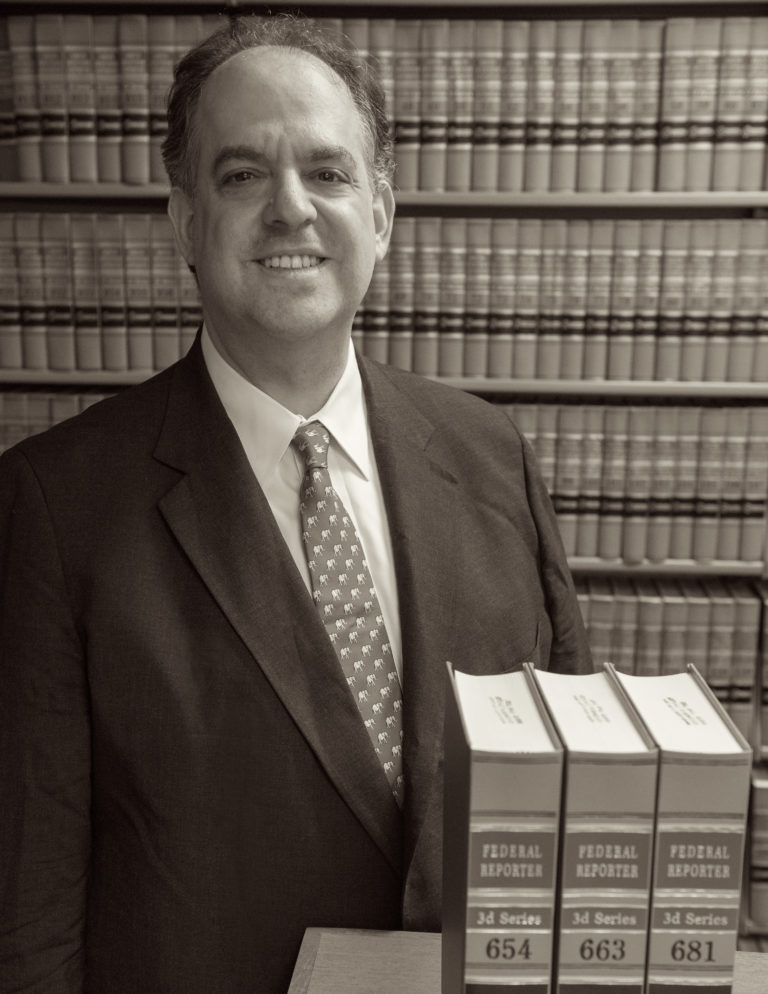

Victory in the Seventh Circuit

CCAF is now 4-1 in federal appeals, which is remarkable, given that CCAF-affiliated attorneys represent the appellant in each case and there are rarely as many as four reversals of class action settlement-related district court opinions in a single year from all objectors combined.