Posner Leaves ‘Enormous Imprint’ on Class Actions

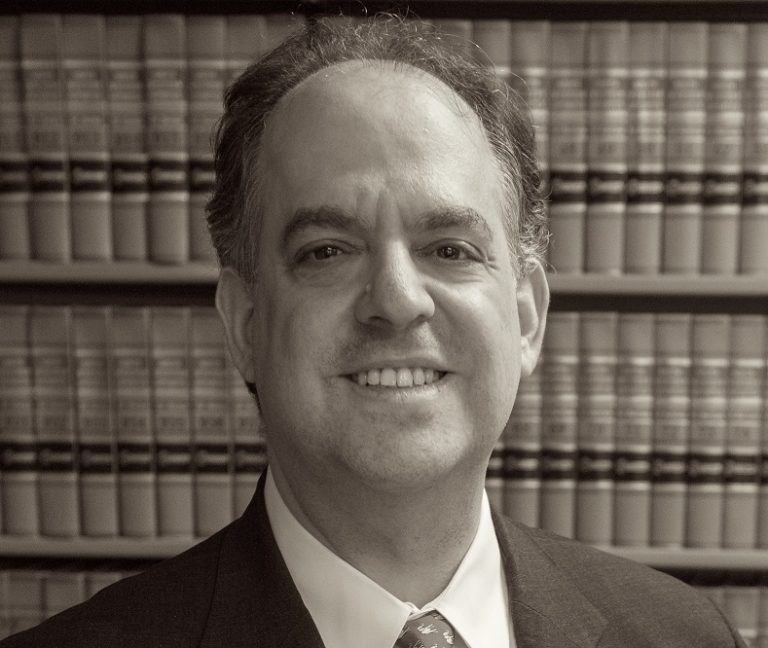

“I’m confident that one day this decade a different court of appeals will disagree with one of those Posner opinions, the Supreme Court will take up the circuit split, and then tell us that Posner was right all along,” Frank said.