Docket numbers: 17-cv-5016, etc. (N.D. Illinois), 18-2220, etc. (7th Cir.)

On April 15, 2024, the Center for Class Action Fairness (CCAF) won an appellate victory on behalf of a shareholder and CCAF director Ted Frank, allowing him to intervene in the cases of six plaintiffs who filed shareholder “strike suits” regarding a then-planned merger. The opinion allows Frank to seek sanctions or other remedies against the plaintiffs and their attorneys, which the Seventh Circuit agreed were engaged in a “racket” to extract meaningless disclosures and attorneys fees. Most mergers of public companies attract similar frivolous suits. By granting Frank standing against filers, CCAF hopes to protect shareholders by curtailing frivolous securities suits.

Background

In 2016 CCAF won an appellate victory over the self-serving Walgreens shareholder settlement, where the Seventh Circuit labelled merger strike suits a “racket” that “must end.” In response to this precedent and others, the tactics of strike suit plaintiffs changed. Instead of agreeing to a class action settlement, recent research shows plaintiffs now instead dismiss cases in exchange for six-figure “mootness fees.”

In the Akorn litigation, CCAF has struck back against these cynical tactics, successfully urging the Northern District of Illinois to exercise its inherent authority on June 24, 2019 to disgorge a $322,500 mootness fee award attorneys obtained from a failed merger. Two of the plaintiffs appealed, and CCAF defended the district court’s decision before the Seventh Circuit.

History

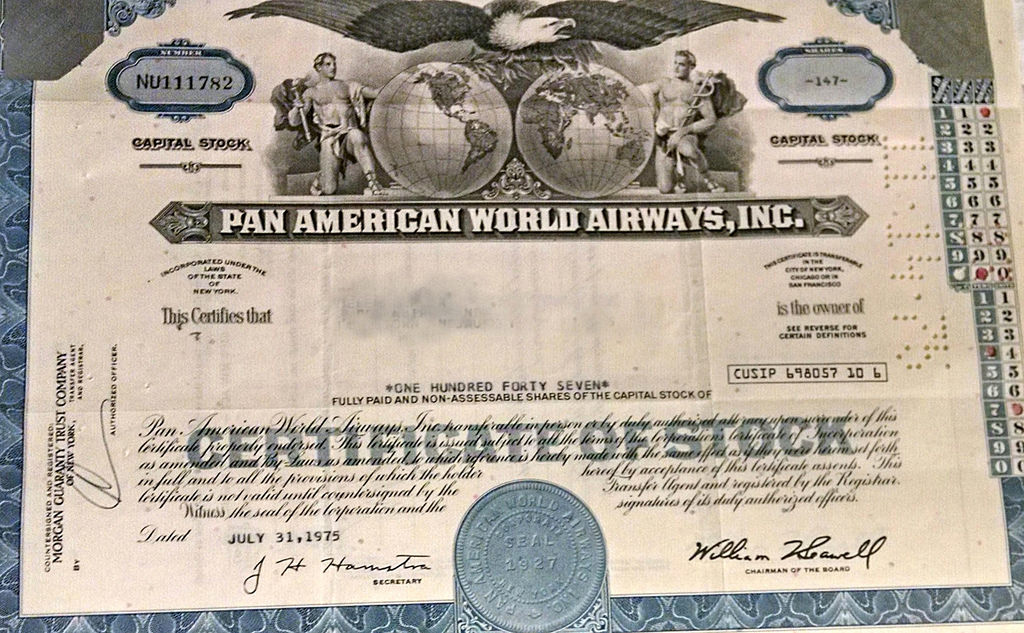

On September 18, 2017, CCAF attorney Theodore H. Frank moved to intervene and vindicate Walgreens’ directive to end such strike suits. The underlying cases concern the acquisition of Akorn, Inc. by pharmaceutical giant Fresenius Kabi AG. Plaintiffs in these suits have convinced Akorn to pay $322,500 in attorneys’ fees, although no benefit has accrued to the class—only immaterial supplemental disclosures, just as in Walgreens. The award of attorneys’ fees constitutes an end-run around Walgreens precedent and also appears to violate the Private Securities Litigation Reform Act (PLSRA) and basic principles of federal class action law.

The Akorn cases illustrate plaintiffs’ shift in tactics since CCAF’s win in Walgreens. Instead of settling merger strike suits, plaintiffs dismiss with the understanding they will apply for “mootness fees,” of hundreds of thousands of dollars per merger. This tactic has spread like wildfire in Delaware and the Federal Courts, and has enabled a dramatic uptick in merger strike suit filings. Suits against 95 merging companies were filed in the first half of 2017 compared to only 28 in the first half of 2016. By intervening in the Akorn cases, Frank and CCAF hoped to disgorge attorneys’ fees unjustly appropriated by strike suit files, and enjoin or at least discourage the filing of frivolous strike suits nationwide.

On May 2, 2018, the district court denied CCAF’s motions to intervene in three of the six Akorn cases because the attorneys had disclaimed any entitlement to attorneys’ fees in those actions. CCAF appealed the district court’s order denying intervention to the Seventh Circuit Court of Appeals and argued the case on November 11, 2018. This appeal is still pending decision.

Meanwhile, CCAF’s motions to intervene in the other three actions were denied on September 25, 2018, but the district court invited Frank to file an amicus brief explaining why it should use its inherent authority to disgorge the attorneys’ fees.

On June 24, 2019, the district court agreed with CCAF’s arguments, agreed that the case should have been “dismissed out of hand,” and ordered that the remaining plaintiffs’ return their attorneys’ fees to Akorn. Two of the three plaintiffs appealed. Frank defended the district court’s decision before the Seventh Circuit at an oral argument heard April 14.

On April 15, 2024, the Seventh Circuit issued its opinion, reversing the denial of intervention in all six cases. The panel dismissed the appeals filed by the two remaining plaintiffs’ firms finding that “they have not explained how, if at all, the district court’s orders adversely affect them, as opposed to counsel.” The panel found that the district court’s order disgorging the mootness fees did not moot Frank’s motion to intervene because he may still move for other remedies. The panel specifically suggested sanctions against the firms under Rule 11, and that “an appropriate remedy (if any)” should be issued after further proceedings.

On remand, Frank is pursuing Rule 11 sanctions against the firms. The district court granted intervention on March 10, 2025 and ordered additional briefing on remedies for the violation of securities law. Several of the filing attorneys filed motions to reconsider.

On February 12, 2026, the district court denied the motions to reconsider and agreed with Frank and issued an order to show cause why sanctions should mot be imposed against attorneys who filed the underlying suite. Briefing on the order to show cause has been extended and will not conclude until May.

This case was formerly a project of the Competitive Enterprise Institute and now is being actively litigated by the Hamilton Lincoln Law Institute.

Case Documents